salt tax cap married filing jointly

This limit on state and local tax is often abbreviated to the SALT deduction cap and was temporarily set at 10000 for single and married filers and 5000 for married couples. The limit is 5000 if married filing.

What Are The Tax Benefits Of Marriage Personal Capital

Do we combine our state and local income.

. Todays announcement does not affect state tax refunds received in 2018 for tax returns currently being filed. Head of a household. T he state and local tax SALT.

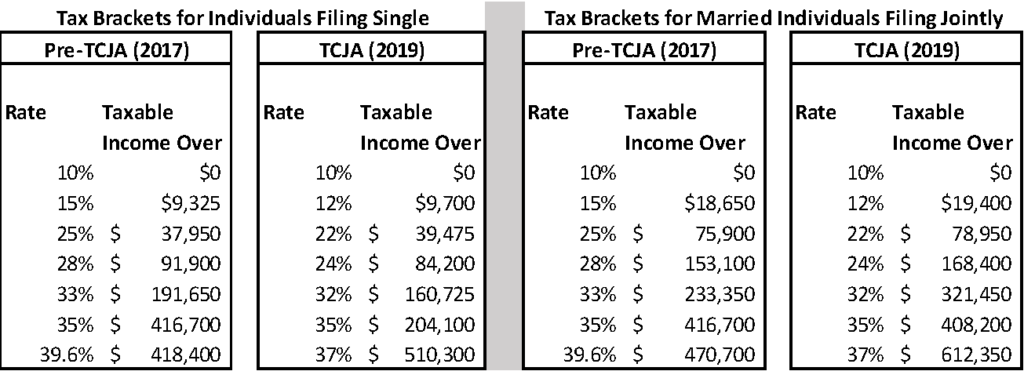

It also aims to double the SALT deduction to 20000 for married couples filing jointly in 2019. Married couples filing jointly. As alternatives to a full repeal of the cap lawmakers and.

That means this tax year single filers and married couples filing jointly can deduct the interest on up to 750000 for a mortgage if single a joint filer or head of. If you paid 5000. It is 5000 for married taxpayers filing.

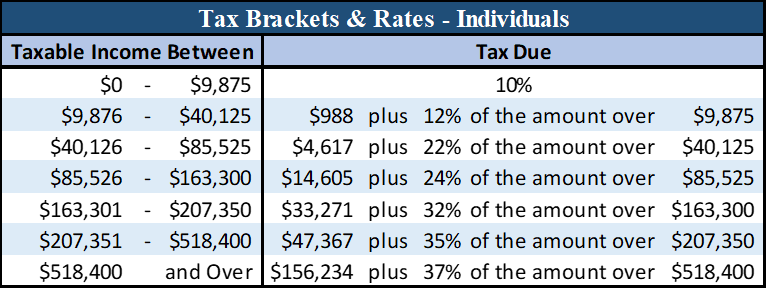

New tax law for 2018. The TCJA established a temporary SALT cap for tax years 2018 through 2025. The Tax Cuts and Jobs Act TCJA enacted in December 2017.

The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. The proposal also addresses an unfair. Senate in early 2020 but has not yet received.

The cap on the SALT deduction started in 2018 because of the Tax Cuts and Jobs Act a tax reform passed in 2017. The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. New tax law for 2018.

The salt cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. Pdf Introduction Some lawmakers are seeking to repeal the 10000 cap for single and married couples jointly filing on state and local tax SALT deductions put in place. For married taxpayers filing separately the cap is 5000.

If you pay state and local taxes during 2021 in the amount of 15000 then you are allowed to take a federal tax deduction of 10000 on your IRS tax return if you itemize. Is this the same number for single married filing jointly and married filing singly. Beginning in 2018 the itemized deduction for state and local taxes paid will be capped at 10000 per return for single filers head of household filers and married taxpayers filing jointly.

Head of household filers and married taxpayers filing jointly. Single taxpayers and married couples filing separately 6350. The bill landed in front of the US.

The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for married taxpayers filing separately. The SALT cap is set at 10000 for single taxpayers or married couples filing jointly and 5000 for. Between 2022 and 2025 the cost of repealing the cap would be 380 billion according to the Tax Foundation.

Under tcja the salt deduction was. 52 rows The deduction has a cap of 5000 if your filing status is married filing. Salt cap of 10000.

Under TCJA the SALT. Today the limit is 750000.

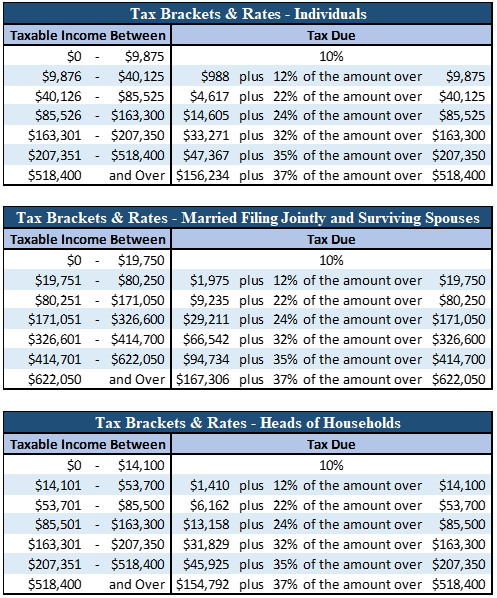

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More Blackman Sloop

Salt Deductions Property And Income And Sales Tax Oh My

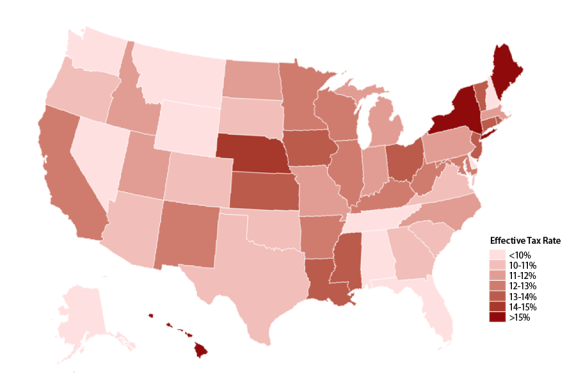

For Most New York Income Tax Filers Salt Deduction Still Isn T Missed Empire Center For Public Policy

How Does The 10 000 Limit On State And Local Tax Deductions Work The Motley Fool

Tax Foundation On Twitter Nkaeding Waysmeanscmte Prior To The Tcja The Amt Hit Taxpayers Making Between 200 000 And 500 000 Hardest In 2015 Almost 60 Of Taxpayers In That Income Range Were Subject

What Is The Salt Deduction H R Block

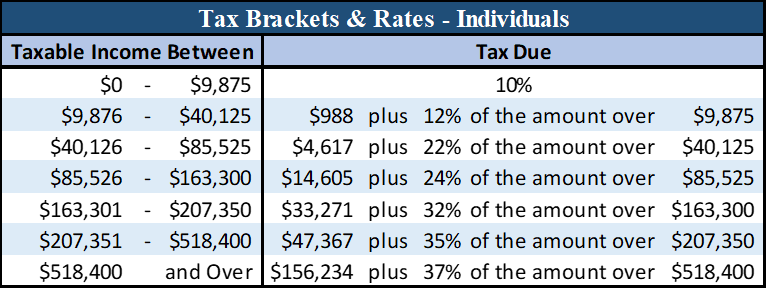

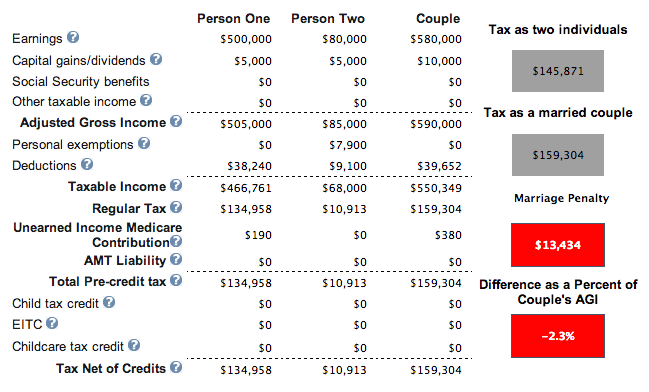

The Marriage Penalty Tax Has Been Abolished Hooray

The 6 Types Of Itemized Deductions That Can Be Claimed After Tcja

Married Filing Joint Or Separate Irs Tax Return Filing Status

The New Year Is In Full Swing Know Your Limits And Get Ready To File Sensible Financial Planning

State Taxation Of Pass Through Entities Cpe Webinar Mycpe

Salt Cap How Nj Taxpayers Should Deal With The Tighter Restrictions

Salt Cap Workaround What You Need To Know Paragon Accountants

The Salt Cap Overview And Analysis Everycrsreport Com

How Does The Deduction For State And Local Taxes Work Tax Policy Center

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

Tying The Knot This Year Add Marriage Tax Penalty To Potential Cost

2020 Irs Releases Including Tax Rate Tables And Deduction Amounts Plus More Dsj Cpa

Some Business Owners May Bypass The Salt Deduction Cap Putnam Wealth Management